Price floor

A price floor is a government- or group-imposed price control or limit on how low a price can be charged for a product.[1] A price floor must be higher than the equilibrium price in order to be effective.

Effectiveness

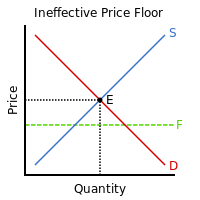

A price floor can be set below the free-market equilibrium price. In the first graph at right, the dashed green line represents a price floor set below the free-market price. In this case, the floor has no practical effect. The government has mandated a minimum price, but the market already bears a higher price.

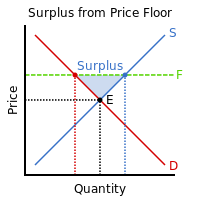

By contrast, in the second graph, the dashed green line represents a price floor set above the free-market price. In this case, the price floor has a measurable impact on the market. It ensures prices stay high so that product can continue to be made.

Effect on the market

A price floor set above the market equilibrium price has several side-effects. Consumers find they must now pay a higher price for the same product. As a result, they reduce their purchases or drop out of the market entirely. Meanwhile, suppliers find they are guaranteed a new, higher price than they were charging before. As a result, they increase production.

Taken together, these effects mean there is now an excess supply (known as a "surplus") of the product in the market to maintain the price floor over the long term. The equilibrium price is determined when the quantity demanded is equal to the quantity supplied.

Further, the effect of mandating a higher price transfers some of the consumer surplus to producer surplus, while creating a deadweight loss as the price moves upward from the equilibrium price.

Minimum wage

An example of a price floor is minimum wage laws; in this case, employees are the suppliers of labor and the company is the consumer. When the minimum wage is set above the equilibrium market price for unskilled labor, unemployment is created (more people are looking for jobs than there are jobs available). A minimum wage above the equilibrium wage would induce employers to hire fewer workers as well as allow more people to enter the labor market; the result is a surplus in the amount of labor available. However, workers would have higher wages. The equilibrium wage for workers would be dependent upon their skill sets along with market conditions.[2]

This model makes several assumptions which may not hold true in reality, however. It assumes the costs of providing labor (food, commuting costs) are below the minimum wage, and that employment status and wages are not sticky. Some current research has shown that in the US, at least, increases in the minimum wage have not led to increased unemployment.[3] Unemployment in the United States, however, only includes participants of the labor force, which excludes 37.2% of Americans as of June 2016. [4]

Europe

Previously, price floors in agriculture have been common around Europe. Nowadays the EU uses a "softer" method: if the price falls below an intervention price, the EU buys the product so much that this decrease in supply raises the price to the intervention price level. Because of this, "butter mountains" now lie at EU stockhouses, not at the producers' stockhouses.[5]

See also

References

- ↑ "Price floor – Definitions from Dictionary.com". dictionary.reference.com. Retrieved 2008-05-02.

- ↑ CBO-The Effects of a Minimum Wage Increase on Employment and Family Income-February 2014

- ↑ "Research Shows Minimum Wage Increases Do Not Cause Job Loss". businessforafairminimumwage.org. Retrieved 24 June 2015.

- ↑ http://data.bls.gov/timeseries/LNS11300000. Retrieved 13 August 2016. Missing or empty

|title=(help) - ↑ Davig Begg et al., Economics, 4th edition, McGraw-Hill 1994, s. 40–43

Further reading

- Rockoff, Hugh (2008). "Price Controls". In David R. Henderson (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.