Landesbank

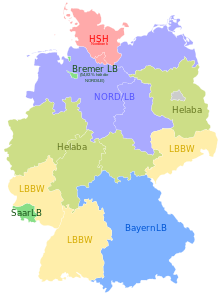

Map of coverage of Landesbanks

The Landesbanken in Germany are a group of state-owned banks of a type unique to Germany. They are regionally organised and their business is predominantly wholesale banking. They are also the head banking institution of the local and regional bases Sparkassen (= saving banks). Landesbanken and Sparkassen comprise one of the three pillars of Germany's banking system. The two other pillars are private commercial banks and cooperatives. Each has a different legal purpose, ownership structure, and governance model. Landesbanken and Sparkassen, as publicly owned entities, are charged by national and state banking laws to pursue an "öffentlichen Auftrag" or public purpose.[1]

- Bayerische Landesbank (BayernLB), Bavaria

- HSH Nordbank, Hamburg + Schleswig-Holstein

- Landesbank Baden-Württemberg (LBBW),

- BW-Bank – Baden-Württemberg Bank (Baden-Württemberg)

- Sachsen-Bank (since April 2008) (Saxony)

- Rheinland-Pfalz Bank (since April 2008) (Rhineland-Palatinate)

- Norddeutsche Landesbank - Girozentrale (NORD/LB), Lower Saxony, Mecklenburg-Vorpommern and Saxony-Anhalt

- Landesbank Hessen-Thüringen (Helaba), Hessen and Thuringia

- Landesbank Berlin (LBB), Berlin, owned by Landesbank Berlin Holding

References

- ↑ Deeg, Richard (1999). Finance Capitalism Unveiled: Banks and the German Political Economy. University of Michigan Press.

See also

- WestLB, former Landesbank of North Rhine-Westphalia

- Raiffeisen Bankengruppe (Austria)

- Raiffeisen Landesbank Südtirol – Cassa Centrale Raiffeisen dell'Alto Adige

- Category:Landesbanks

- German public banks#Landesbanken

External links

- http://www.faz.net (Bilanzsummen minus 1.809.100.000.000 Euro) (Stand September 2010) (Schuldenbremse Grundgesetz)

This article is issued from Wikipedia - version of the 11/10/2016. The text is available under the Creative Commons Attribution/Share Alike but additional terms may apply for the media files.